What is a Personal Financial Statement Form?

A personal financial statement form provides all the basic details about an individual's holdings. It acts as a record that shows their assets, liabilities, annual income, expenses, and other general information in detail. To get to know more about how your finances have been working out lately, the use of a personal financial statement is considered quite necessary.

With the help of such forms, an individual shows himself the position that they lie in, but it also helps the authorities get to know much more about you, which would lead to some benefits. Using a proper personal financial statement form helps you include every small detail about your assets, which is believed to be accurate.

Information Required on a Personal Financial Statement Form

The personal financial statement form takes up a very good set of information conclusively. As the objective is to know much more about the person in the form, there is much information that can be included in the discussion. Before filling out a personal financial statement template, ensure that you go through this list of information.

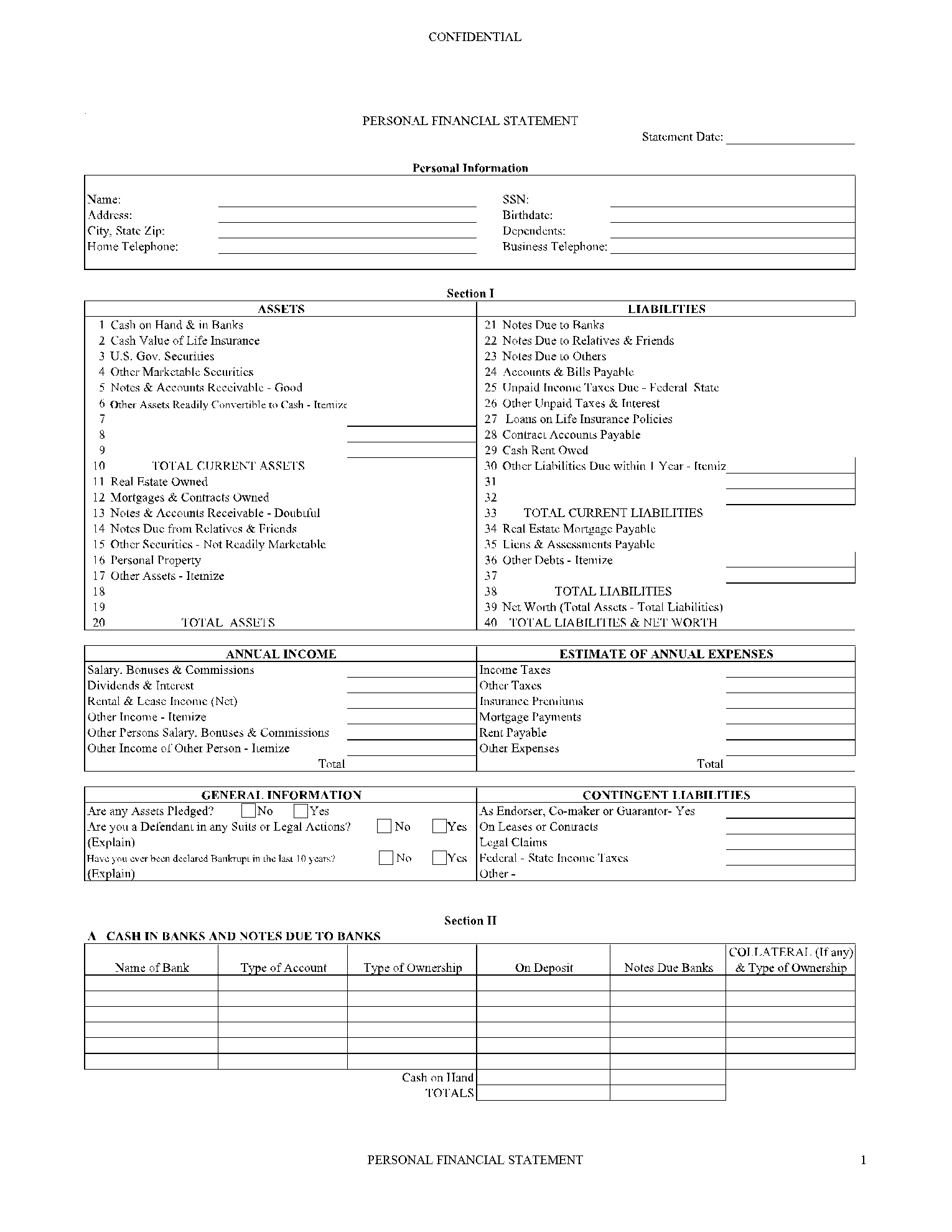

- Provide a complete introduction about the personal knowledge of the individual. It includes their name, address, telephone details, SSN, DOB, and dependents, if any.

- Cover the list of all the assets that outline the complete holdings of the user at the moment. Calculate the complete amount of assets that exist.

- Proceed to discuss the liabilities that prevail for the user. While calculating the total liabilities that exist for any individual, move forward to make a conclusive calculation about the person's net worth.

- Include details about the annual income followed by the annual expense.

- Answer all questions associated with the property of it being pledged, etc. Provide all the contingent liabilities which show any legal claims proceeded to the government.

- The next section of the form ensures that the user adds all minute details about the cash present in the banks, life insurance, securities owned, notes, and amounts receivable, real estate, and mortgages owned. With these details, the conditions are more prevalent, and a lot can be achieved with the results.

- Add in the signatures of the user who is applying for a personal financial statement.

How to Fill Out a Personal Financial Statement Form?

The complete process of filling out the personal financial statement template is very simple. The user needs to look into the following steps.

Step 1: Add the information about the individual providing the details about their financial statement.

Step 2: Include the assets and calculate their total count. Add in the details of the liabilities, calculate the total value, and record the net worth.

Step 3: Provide all the details about the income and the expenditure that has been performed. Following this, the form provides users with options to include separate details about their assets.

Step 4: Sign the form with the appropriate date to conclude.

What is a Personal Financial Statement Form Used For?

Personal financial statements are very helpful and detailed in cases where it involves information from investors. This information provides them with a very comprehensive introduction about the individual or the company that fills up the form. This is very important to decide whether the party would meet the short-term and long-term financial obligations. The allocation of resources improves by a lot.